Role of the 1098 Mortgage Interest Form in Taxation

IRS Form 1098 is commonly called the "Mortgage Interest Statement." This is a document that reports the amount of interest and related expenses paid on a mortgage within a tax year. This form is sent by the mortgage lender to both the Internal Revenue Service (IRS) and the borrower. Individuals can use the information provided on the printable 1098 tax form to potentially claim deductions on their federal returns, which could lower their taxable income and the amount of taxes they owe.

Our Website Advantages

Understanding and completing tax statements can be challenging; however, the website 1098-form-printable.net offers valuable resources to ease this process. It provides a blank 1098 mortgage interest form that taxpayers can download and print. Additionally, federal form 1098 instructions are available, guiding individuals through each step required to accurately report their mortgage interest payments. This assistance ensures that users can fill out Form 1098 correctly and maximize their potential tax benefits.

Obligation to File the 1098 Tax Form for 2023

In the United States, IRS Form 1098 printable for 2023 must be filed by any individual or entity that receives $600 or more in interest from a borrower during the tax year. This document is particularly relevant for mortgage lenders, banks, or other financial institutions that provide loans for real estate purchases. Homeowners who have paid mortgage interest throughout the year expect to receive this document for their tax deductions.

IRS Form 1098: Purpose & Features

-

![Interest Reporting]() Interest ReportingThe 1098 form plays a critical role in documenting the amount of mortgage interest an individual has paid during the tax year. This figure is necessary for homeowners to claim a potential tax deduction.

Interest ReportingThe 1098 form plays a critical role in documenting the amount of mortgage interest an individual has paid during the tax year. This figure is necessary for homeowners to claim a potential tax deduction. -

![Tax Preparation]() Tax PreparationPreparing your taxes accurately is essential, and the 1098 printable form provides important information. For individuals who have paid mortgage interest, this statement reports those payments to both the taxpayer and the IRS, assisting in the correct filing of returns.

Tax PreparationPreparing your taxes accurately is essential, and the 1098 printable form provides important information. For individuals who have paid mortgage interest, this statement reports those payments to both the taxpayer and the IRS, assisting in the correct filing of returns. -

![Lender Accountability]() Lender AccountabilityLenders or mortgage servicers must send this important document to the borrower to ensure transparency and adherence to tax reporting requirements. The document confirms the amount the lender has received in mortgage interest.

Lender AccountabilityLenders or mortgage servicers must send this important document to the borrower to ensure transparency and adherence to tax reporting requirements. The document confirms the amount the lender has received in mortgage interest.

Print the 1098 Form for 2023

Get Form

Consider a Case

Let's imagine Sarah, a bank loan officer in her mid-40s, who responsibly manages numerous mortgages issued by her bank. Within the past year, she has overseen accounts that have collectively accumulated more than $600 in interest from each borrower. Given this situation, Sarah must ensure that her bank prepares and files the 1098 mortgage interest statement

to each qualifying borrower. This enables each homeowner to potentially claim their mortgage interest as a deduction on their tax returns.

Additionally, Sarah must ensure that the homeowners can easily print the 1098 tax form from the bank's online portal. This accessibility assists customers in promptly receiving their forms, ensuring they can meet their tax filing obligations without any hiccups. Sarah's role is vital in keeping the bank and borrowers compliant with IRS regulations during tax season.

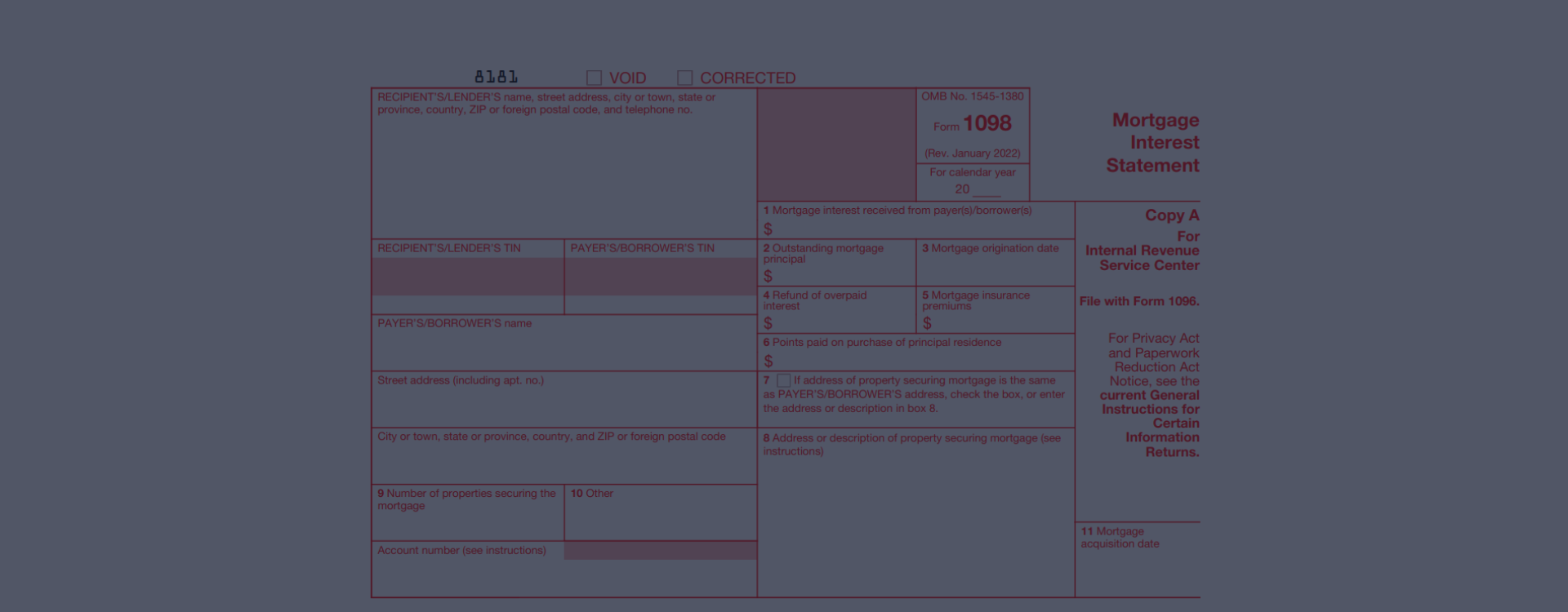

Instructions to Fill Out the 1098 Printable Form

Filling out the IRS Form 1098 is an important task that requires attentiveness to ensure accuracy. Typically, this statement reports mortgage interest of $600 or more received by a mortgage lender during the year. When preparing to complete this document, our website offers a free printable 1098 form for 2023 that you can download or fill out online. This convenient access simplifies the process by allowing you to have the necessary template at your fingertips.

- To fill out the blank template correctly, begin by entering the lender's name, address, and taxpayer identification number in the corresponding boxes at the top.

- Following this, you'll input the borrower's name, address, and social security number. Refer to the Form 1098 example, which illustrates where each piece of information should be placed.

- Record the interest amount received in box 1, being careful not to include points or any other interest.

- If you have an amount in box 2 for points paid on the purchase of a principal residence, make sure it is accurate.

- Should you require an electronic version or a guide to help you through the process, the IRS Form 1098 in PDF format can also be found on our website, providing clear instructions and a visual layout of the statement.

- Avoid common mistakes by double-checking all numbers and ensuring the borrower's information matches their tax records.

- Before submission, review the entire document to ensure all necessary information is included and accurate, reducing the chance of issues or delays with the IRS.

IRS Form 1098 in PDF

For added convenience, you have the option to file Form 1098 online in PDF format. Doing so helps streamline the process and may ensure your information is processed more quickly. Always remember to double-check your details for accuracy to avoid unintended mistakes.

Form 1098 for 2023 - Due Date

If you are preparing to handle your tax responsibilities, it's important to know when to submit key documents. For example, suppose you need to report mortgage interest to the Internal Revenue Service (IRS). In that case, you must send the printable 1098 mortgage interest form by January 31st, following the fiscal year the payments were made. This document is crucial for homeowners and the IRS to ensure the proper amount of mortgage interest is reported.

Get FormIRS 1098 Mortgage Interest Statement: People Also Ask

- What is Form 1098, and where can I get it?Lenders use this federal tax form to report interest and other related amounts you paid on your mortgage during the fiscal year. You can access an IRS 1098 form printable version directly from our website, or you may receive a copy from your mortgage lender if you meet certain conditions requiring them to send you one.

- Can I print a blank 1098 form to fill out myself?Yes, it’s possible to obtain the federal tax form 1098 printable to fill out. By following the link from our website, you can download the blank template in PDF or print the copy online. Keep in mind that this form is typically prepared by your mortgage lender, who sends both you and the IRS a copy.

- Is there a charge for printing Form 1098?No, you can print the 1098 form printable for free from our website. Simply scroll to the top of the page and click the "Get Form" button. All you need is access to a printer and the correct form that corresponds to the tax year in question.

- How do I know if I need to use the federal form 1098 for my taxes?You will need to use the blank 1098 form printable if you have paid $600 or more in mortgage interest to a lender within the tax year. The lender is usually required to send you this document by January 31st, after the end of the tax year. However, if you haven’t received it, you should request one from your lender or download it for your tax records.

- Where can I find a sample of the 1098 form to ensure I am filling it out correctly?For those seeking a visual guide, a 1098 sample can be found on our website. This example will show you how the document should look once it’s correctly completed, providing a useful reference when you’re reviewing the form sent by your lender or when filling out your own.

More Instructions for the 1098 Tax Form

1098 Form - Mortgage Interest The 1098 mortgage tax form has been a key document for homeowners in the United States for many years. It was introduced by the Internal Revenue Service (IRS) to facilitate the proper reporting of certain types of interest payments. Essentially, this form plays a crucial role in personal finance and...

1098 Form - Mortgage Interest The 1098 mortgage tax form has been a key document for homeowners in the United States for many years. It was introduced by the Internal Revenue Service (IRS) to facilitate the proper reporting of certain types of interest payments. Essentially, this form plays a crucial role in personal finance and... - 7 December, 2023

- Fillable 1098 Form Today, we shall demystify one such document – Form 1098, which plays a crucial role for those who have taken a mortgage. This document, officially titled the Mortgage Interest Statement, is necessary for many taxpayers. Essentially, it outlines the amount of mortgage interest and related expen...

- 6 December, 2023

- IRS Tax Form 1098 Instructions Tax time can be complex, but understanding the necessary forms is a great place to start. One important form is 1098, often referred to as the Mortgage Interest Statement. This document plays a vital role for many homeowners. Essentially, it's a report of the interest you've paid on your mortgage ov...

- 5 December, 2023

Please Note

This website (1098-form-printable.net) is an independent platform dedicated to providing information and resources specifically about the 1099 tax form, and it is not associated with the official creators, developers, or representatives of the form or its related services.