1098 Form - Mortgage Interest

- 7 December 2023

The 1098 mortgage tax form has been a key document for homeowners in the United States for many years. It was introduced by the Internal Revenue Service (IRS) to facilitate the proper reporting of certain types of interest payments. Essentially, this form plays a crucial role in personal finance and taxation, allowing individuals to deduct mortgage interest expenses from their taxable income potentially. Over time, this document has been refined to ensure more accuracy and ease of understanding for both taxpayers and the IRS.

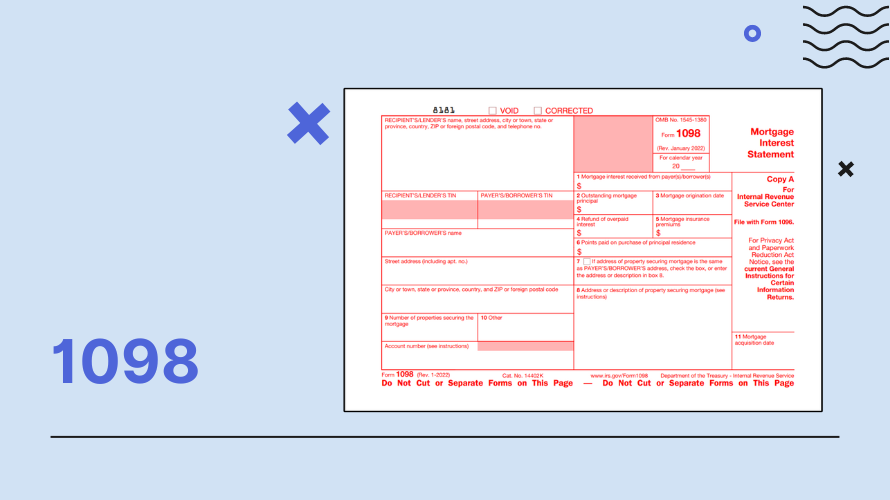

Recent Changes to the IRS 1098 Mortgage Form

To streamline tax filing procedures, the IRS occasionally updates tax forms, including Form 1098. One of the main changes in recent years included an update to the reporting requirements. Mortgage lenders must now provide a more detailed account of the loan, like the amount of outstanding principal, the date of origination, and the address of the property securing the mortgage. These updates aimed to provide greater transparency for the IRS and the homeowner.

Eligibility for the IRS 1098 Form

The 1098 form for mortgage interest reporting is specifically used by financial institutions or entities that receive payments of $600 or more from an individual during the tax year. Therefore, not every homeowner will receive a 1098 form. For example, if your mortgage interest paid during the year doesn't surpass the $600 threshold, the lending institution isn't obligated to send you this form. Conversely, those who have paid more than $600 in interest should expect to receive a Form 1098 from their mortgage lender.

Obtaining the 1098 Mortgage Interest Statement

If you are eligible to deduct mortgage interest from your taxes, you'll likely want to know how to get a 1098 mortgage interest statement. Your mortgage lender typically sends this crucial document by January 31st, following the tax year in question. If you haven't received it by mid-February, contacting your lender is advisable. Additionally, you should ensure that your lender has your most current address to avoid any mailing issues.

Tips for Accurate 1098 Form Reporting

- Check Your Information

Before you begin to fill out the 1098 mortgage form, verify that all the personal information provided is correct. Mistakes in your name, address, or account number can lead to processing delays. - Understand the Deductions

Ensure you fully comprehend which portions of your mortgage payments qualify for a deduction. It's typically the interest and not the principal or escrow payments. - Use the Correct Form

Double-check that you have the right form for the right year. Using an outdated version can cause errors. - Seek professional Help

If you are unsure about how to approach this process, consider consulting with a tax professional. They can provide guidance and help ensure that your reporting is done without errors or delays.

The importance of the IRS 1098 mortgage form is undeniable for those looking to deduct mortgage interest. The correct understanding of this document and timely submission could result in significant tax savings, making it valuable during tax season. By following the above tips, homeowners can report their mortgage interest smoothly, accurately, and on time.